Introduction

What is this?

Lorem ipsum dolor sit amet, duo ut putant verear, nam ut brute utroque. Officiis qualisque conceptam te duo, eu vim soluta numquam, has ut aliquip accusamus. Probo aliquam pri id. Mutat singulis ad vis, eam euismod pertinax an, ea tale volumus vel. At porro soleat est. Debet facilis admodum an sed, at falli feugiat est.

TODO

My favorite personal finance blogs:

Compound growth

TODO: Figure

The Compound Annual Growth Rate (CAGR), using the sampling frequency of \(\ell=252\) trading days per year, is

\[ r_\mathrm{CAGR}(t) = \left( \frac{a(t)}{a(t_{0})} \right)^{\ell/(t - t_{0})} - 1 \]

The portfolio problem

What mix of assets should I hold to preserve and accrue value over time?

TODO

This is the subject of 3 Portfolio theory.

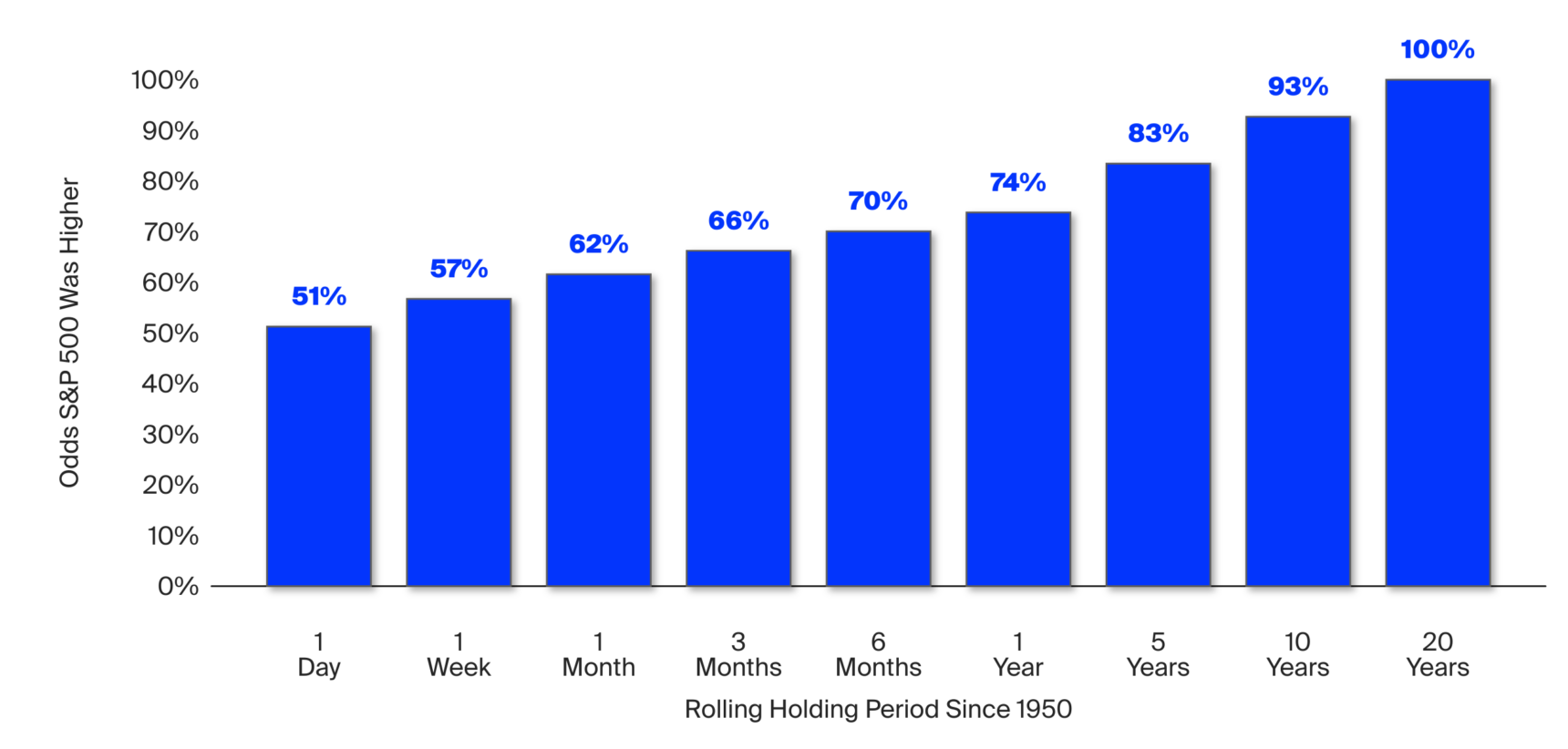

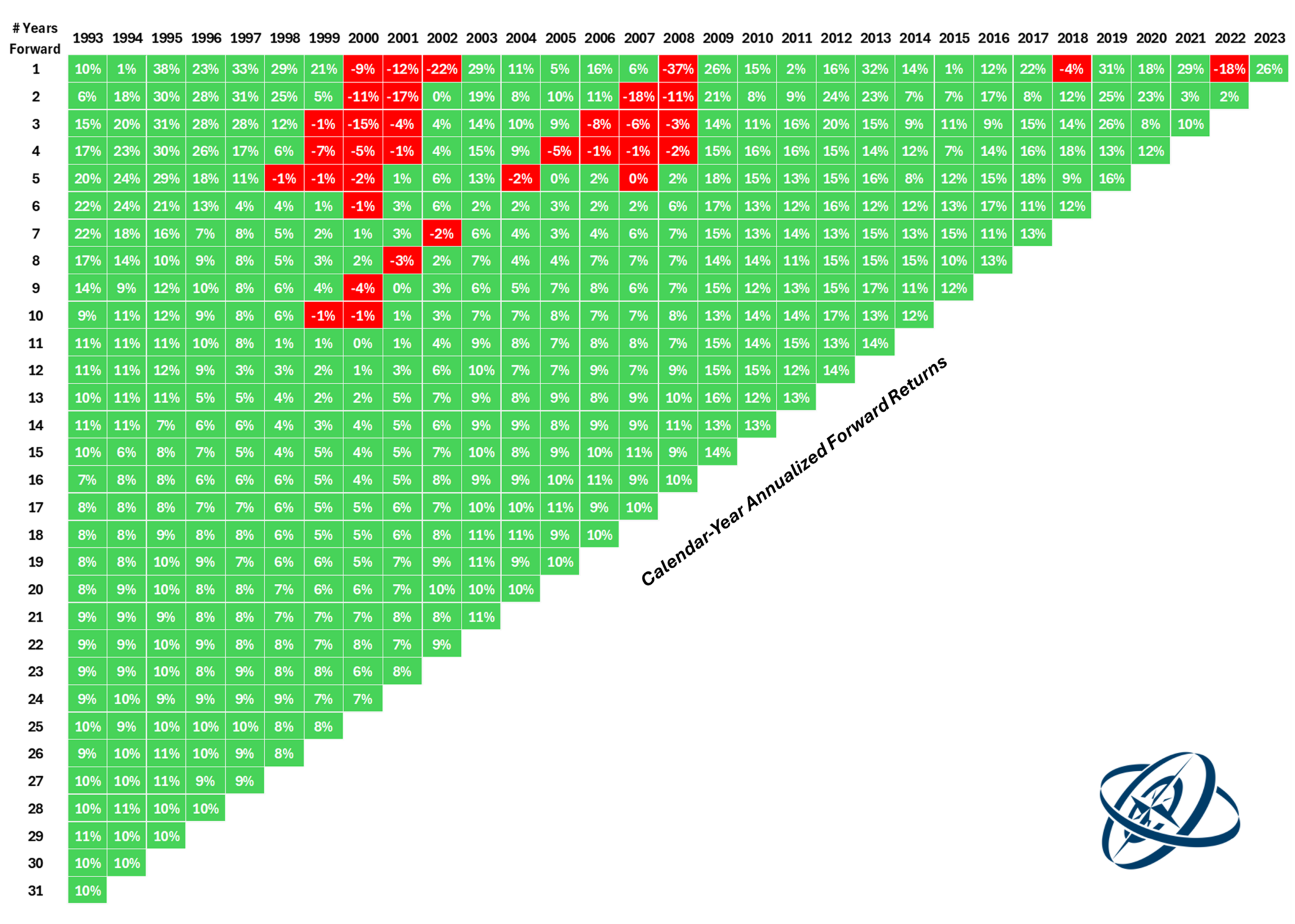

Active vs passive investing

- Trading vs investing

- Dollar Cost Averaging (DCA)

- Brinson, G.P., Hood, L.R., & Beebower, G.L. (1986). Determinants of portfolio performance. 1

- Brinson, G. P., Singer, B.D., & Beebower, G.L. (1991). Determinants of portfolio performance II: An update. 2

- Hood, R.L. (2005). Determinants of portfolio performance: 20 years later. 3

Why isn’t technical analysis discussed here?

TODO:

- “Technical analysis” is mostly bullshit

- Aronson (2007)